Understanding industry Credit Cycles is paramount

Unlocking credit cycles is a key objective of Z-Risk Engine and understanding industry credit cycles is paramount to converting TTC credit models into PIT ones before assessing ECLs forward-in-time.

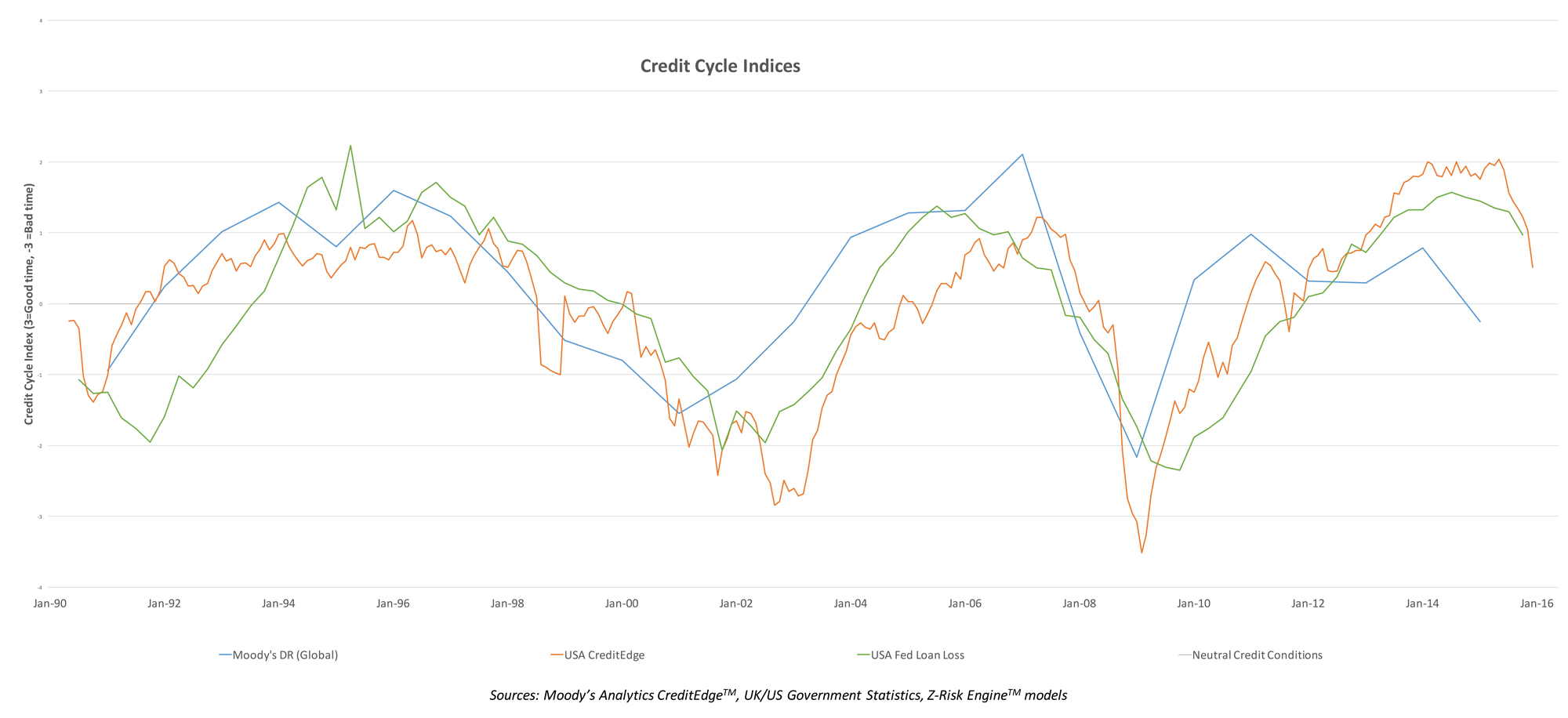

As can be seen in the graphic below; over the last 30 years, using various measures like Credit Edge EDFs, US Loan Charge-offs and Moody's Default rates, credit cycles are real. Accurately assessing them is a key capability of Z-Risk Engine that supports IFRS9/CECL and Stress Testing in a single solution.