Approved IFRS9 and CECL / Stress Testing solution offering advanced accuracy and analytics.

Z-Risk Engine is an IFRS9 approved (regulatory and accounting) and CECL / Stress Testing integrated solution for major global banks – all on a single platform.

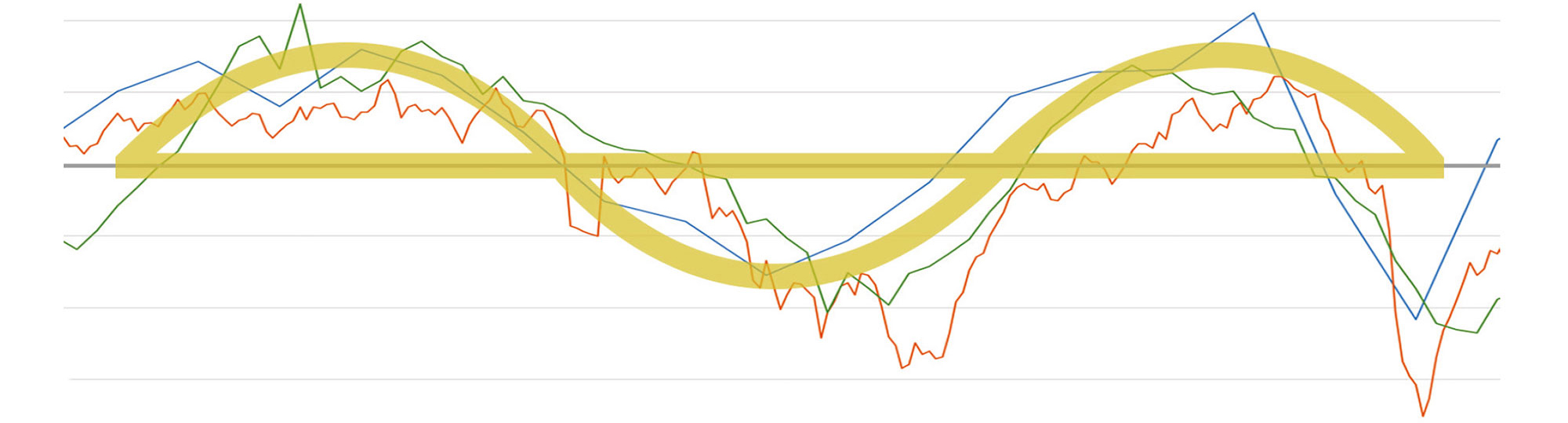

Highly accurate IFRS model using Full Point-in-Time (PIT) conversion of bank’s own Hybrid internal credit models by incorporating detailed credit cycles, delivering up to 30% reduction in modelling operational costs.