Articles, Climate Risk

25 Mar 24

Research Paper with support from CGFI

An Integrated Credit/Climate Scenario Approach Combining Firm-Level Climate Sensitivity with Climate Volatility Add-Ons

Articles, Climate Risk

1 Feb 24

Our latest Climate article for GARP is published

Based on our long-term experience building and implementing credit models E2E, we list four ideas for bank’s Climate Risk Stress Testing agenda for 2024 and beyond.

Articles, Climate Risk

26 Oct 23

GARP Sustainability & Climate article

Today our Sustainability & Climate article was published on GARP: ‘Climate Trends, Narratives, Shocks and Climate Stress Scenarios’.

Articles, Climate Risk

16 Oct 23

Climate Stress Test Briefing Note

This briefing note takes us through comments on the revised ECB climate stress test approach.

Articles, Climate Risk

18 Sep 23

Climate Risk Stress Testing Research Note 5

This papers takes us through Introducing Firm-Level Climate Risk Sensitivity into Climate Credit Factor Simulations.

News and Events

5 Sep 23

ZRE Speaking at upcoming Climate Stress Testing Forum in London

ZRE's Managing Director, Dr Scott D. Aguais, will be speaking at this forum taking place in London on Wednesday 29th November 2023.

Articles, Climate Risk

16 Aug 23

Climate Risk Stress Testing Research Note 4

This papers takes us through Developing A Short-Term Climate Stress Scenario to 2030 – Combining Climate Narratives with Empirical Credit Model Shocks Benchmarked to the ‘Great Recession’.

Climate Risk, News and Events

13 Jun 23

Presentation and Q&A discussion from our Integrated Climate Stress Test Webinar

This deck describes our views on an overall climate stress test framework that would include running various climate stress test scenarios through the Z-Risk Engine solution.

Articles, Climate Risk

5 Jun 23

Climate Risk Stress Testing

This papers takes us through Developing Climate Scenario Impacts on Credit Models – Applying the ECB Climate Stress Test Approach Through ‘TTC PD Drift’

News and Events, Climate Risk

18 May 23

ZRE Webinar, 7th June

REGISTRATION NOW OPEN – 7th June 2023, 3pm BST (GMT+1) – join us for our webinar ‘An Integrated Credit Risk Based Scenario Approach to Climate Stress Testing’.

News and Events, Climate Risk

21 Apr 23

Climate Risk Stress Testing Research Published on Frontiers

Our recent Climate Risk Triptych research papers have been published by Frontiers under the title: Climate-change scenarios require volatility effects to imply substantial credit losses: shocks drive credit risk not changes in economic trends.

Articles, Climate Risk

17 Apr 23

Climate Risk Stress Testing – Research Note Number Two

This research note assesses a second climate use case for developing long-run climate scenarios, in this case for potential, narrow ‘socio-economic tipping point’ (‘SETP’) shocks.

Articles, Climate Risk

15 Mar 23

Climate Risk Stress Testing – Research Note Number One

This research note summarizes broad empirical aspects of recent climate change discussions in the industry concerning climate stress testing and the potential influences of climate change on credit risk in the banking system.

News and Events

14 Nov 22

Presentation from RiskMinds International, 9 November, Barcelona

Our presentation titled 'Developing an Empirically-Based Climate Credit Risk Stress Test Framework' from RiskMinds International in Barcelona last week.

Climate Risk, Climate Risk Triptych Papers

7 Nov 22

Climate Change Credit Risk Triptych Paper One

Smooth NGFS Climate Scenarios Imply Minimal Impacts on Corporate Credit Losses

Climate Risk, Climate Risk Triptych Papers

7 Nov 22

Climate Change Credit Risk Triptych Paper Two

Climate Change Volatility Effects Imply Higher Credit Losses

Climate Risk, Climate Risk Triptych Papers

7 Nov 22

Climate Change Credit Risk Triptych Paper Three

Climate Change Macro Volatility Effects Imply Higher Credit Losses

Climate Risk

6 Nov 22

Summary of Climate Stress Test Findings

A short presentation summarizing the key findings of the research papers published at RiskMinds International, November 7, 2022.

News and Events, Climate Risk

12 Sep 22

ZRE Speaking and launching new research at RiskMinds International, Barcelona 2022

ZRE's Managing Director, Dr Scott D. Aguais, will be speaking at RiskMinds International in Barcelona, 7-10th November 2022, on the topic of Developing An Integrated, Empirically-Based Climate Stress Test Framework

Case Studies

5 Sep 22

DBS Case Study

This Case Study highlights the ZRE implementation at DBS Bank in Singapore including full integration of the ZRE Engine into DBS’ Capital Reporting and Stress Testing platform for the purpose of ECL reporting in 2021.

Articles

21 Jun 22

Presentation from the Marcus Evans Climate Risk And Stress Testing Conference

Our presentation ‘Musings on Long Run Climate Stress Test Modelling for Banks’ from last week’s Marcus Evans' Climate Risk And Stress Testing Conference.

Articles

6 Jun 22

Presentation from the 2nd MRMIA Best Practices Virtual Summit

Our recent presentation from the MRMIA conference, ‘Risks in Models of Climate Change Impacts’, discussing stress testing and modelling approaches for dealing with Uncertainty vs Risk for climate models developed to project future climate impacts when general uncertainty is high.

News and Events

26 May 22

ZRE participating at the 2nd MRMIA Best Practices Virtual Summit

ZRE Founder Dr Scott D. Aguais will be participating on Thursday 2nd June (3pm UK time) at the webinar titled "Risks in Models of Climate Change Impacts"

Articles, Climate Risk

3 May 22

Presentation from the ESG Europe Conference in London, April 2022

Presentation by Dr Scott D. Aguais titled 'Musings on Long Run Climate Risk Modelling for Banks'.

News and Events, Climate Risk

16 Mar 22

ZRE Speaking at Climate Risk and Stress Testing, London, 16 June

ZRE's Managing Director, Dr Scott D. Aguais, will be speaking in London to share insights on Long-run Climate Risk Modelling

News and Events

10 Mar 22

ZRE Speaking at ESG Europe, London, 27 April

ZRE's Managing Director, Dr Scott D. Aguais, will be speaking on day one about Long-Run Climate Risk Modelling for Banks.

Articles

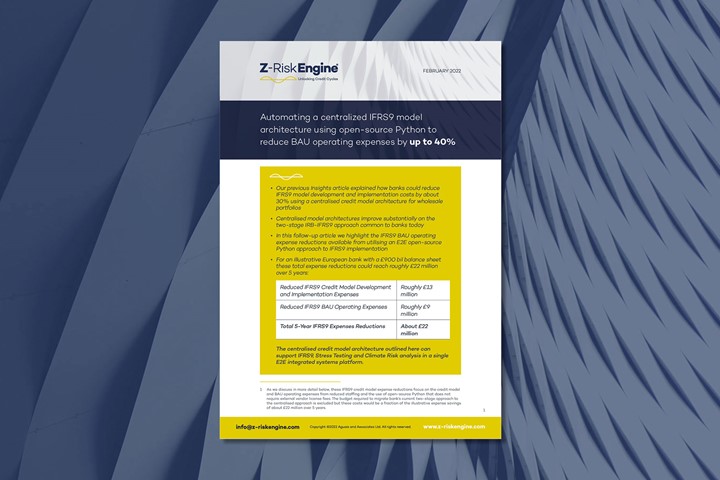

15 Feb 22

Using a centralized IFRS9 model architecture and Python to reduce BAU operating expenses by up to 40%

In this follow-up article we highlight the IFRS9 BAU operating expense reductions available from utilising an E2E open-source Python approach to IFRS9 implementation

Articles

7 Feb 22

Presentation from the 15th Annual Banking & Credit Risk Conference

Centralized IFRS9 Credit Model Solutions Can Enhance Point-in-Time Accuracy and Substantially Reduce Implementation and Operating Expenses

Articles

29 Nov 21

IFRS9 Credit Model budgets can be reduced by up to 30%

We calculate in an illustrative benchmark exercise described in this article, that banks could save up to 30% of their credit model operating budgets by utilizing a single, holistic IFRS9 model architecture.

News and Events

21 Oct 21

ZRE Sponsors 15th Annual Banking Credit Risk Management Summit

Z-Risk Engine is proud to sponsor the 15th Annual Banking Credit Risk Management Summit to be held in Vienna on 2nd – 3rd February 2022.

Brochures

19 Oct 21

Z-Risk Engine Introduction

View and download our 1-page introduction to ZRE: an approved IFRS9 / CECL / Stress Testing solution offering advanced accuracy and analytics, and up to 30% reduction in modelling operational costs.

Articles

23 Mar 20

ZRE Coronavirus PIT ECL Impact Analysis 23-MAR-20

Indirect effects on a US/UK hypothetical credit portfolio as of March 23, 2020

Articles

16 Mar 20

ZRE Coronavirus PIT ECL Impact Analysis 16-MAR-20

Indirect Effects on a US/UK Hypothetical Credit Portfolio as of March 16, 2020

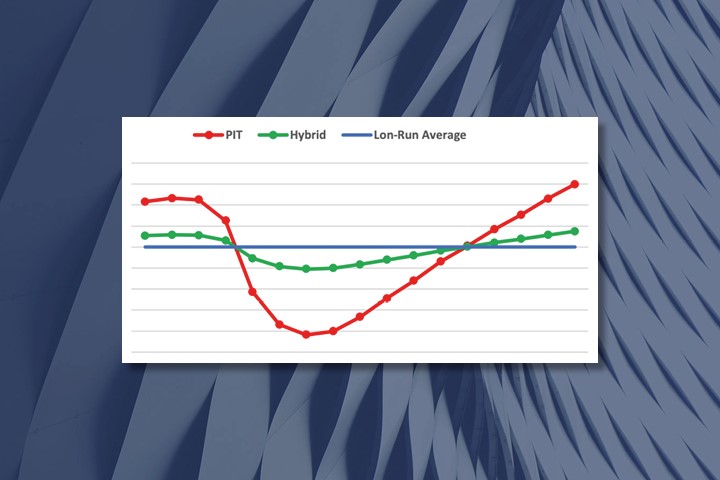

Articles

17 Sep 19

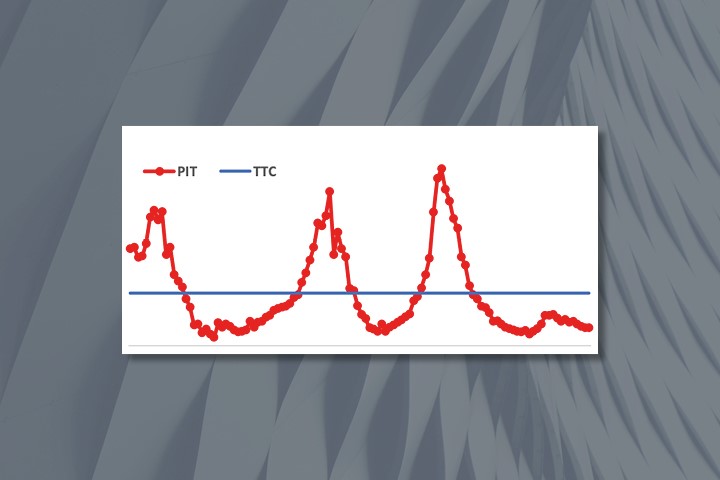

Inaccuracies Caused by Hybrid Credit Factors

Explaining the way in which hybrid models differ from PIT ones and presenting evidence that many banks are struggling with PIT estimates which are extremely important for accurate IFRS9/CECL and Stress Test assessments.

Articles

5 Jun 19

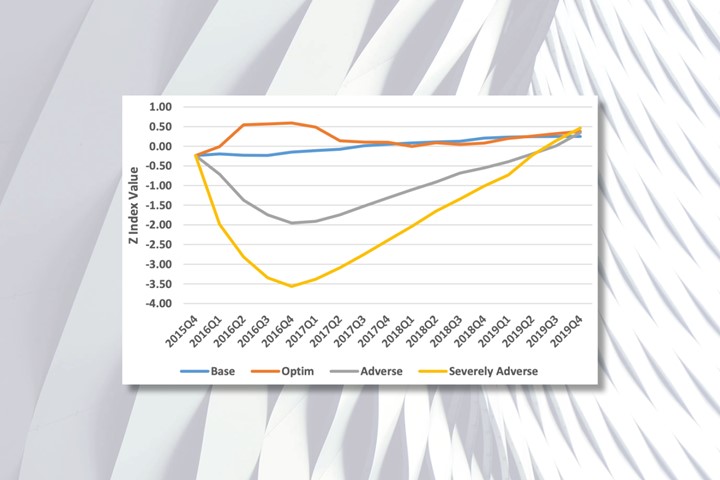

Stress Understatement Using GDP Drivers

To obtain accurate estimates of cyclical variations in credit losses, banks must include fully PIT, market-value-related, risk factors as drivers. Otherwise, the results would understate intertemporal variations related to the credit cycle.

Articles

11 Apr 19

Variance Compression Bias in Expected Credit Loss Estimates Derived from Stress-Test Macroeconomic Scenarios

Articles

28 Jun 17

Risk.net Article

In this Risk.net article on the potential volatility of IFRS9 loss projections where Z-Risk Engine (ZRE) MD, Dr Scott D. Aguais provides key commentary and explanation on how the ZRE solution is well placed to meet these new challenges.

Articles

24 Apr 17

Comments in response

Comments in response to “A point-in-time–through-the-cycle approach to rating assignment and probability of default calibration”

Articles

22 Sep 16

Some options for modelling Significant Deterioration in IFRS9

In this study, we model IFRS9 Significant Deterioration from an end-to-end perspective covering topics such as PIT PD term structure, data based triggers, trigger design, threshold levels and implementation.

Final version published in Journal of Risk Model Validation, Q3 2016 edition.

Articles

11 Aug 16

Risk.net Article

Article about Z-Risk Engine developers titled 'The new A to Z of risk modelling' published in the August edition of Risk magazine, describing the evolution of the PIT/TTC framework and the journey taken by Z-Risk Engine developers.

Articles

28 Jun 16

Convexity and Correlation Effects in Expected Credit Loss calculations for IFRS9/CECL and Stress Testing

In this study, we demonstrate that the convexity of PD functions together with correlation among PD, LGD, and EAD outcomes impart skewness to the credit-loss, probability distribution function (PDF) and increase the expected credit losses (ECLs) by as much as 20% or more.

This article will be published in Journal of Risk Management in Financial Institutions (JRMFI) Volume 9 / Number 4 / Autumn, 2016

Articles

22 Mar 16

Point in Time LGD and EAD models for IFRS/CECL and Stress Testing

In this journal article, we offer options for formulation of PIT LGD and EAD models, and show that, by accounting for the probabilistic evolution over time in industry-region credit-cycle indices, one can derive joint, PD, LGD, EAD scenarios for use in IFRS9/CECL and Stress Testing. Contact us for the final published article.

Articles

17 Jun 15

Biased Benchmarks

In this journal article, we show evidence that indicates that benchmarks like agency ratings have over the last 11 years, been exaggerating default risk for corporate entities. Contact us for the final published article.

Articles

15 Jul 13

Comment in response

Comment in response to "A methodology for point-in-time–through-the-cycle probability of default decomposition in risk classification systems". In this journal article, we critique Carlehed and Petrov's PIT/TTC methodology and refute some of their claims. Contact us for the final published article.

Articles

23 Jan 07

Designing and Implementing a Basel 2 Compliant PIT-TTC Ratings Framework

This journal article provides the foundation of PIT-TTC Ratings framework.

Articles

28 Oct 04

Point-in-Time versus Through-the-Cycle Ratings

This journal article provides the foundation of PIT-TTC Ratings framework.

Articles

11 Dec 01

Enterprise Credit Risk Management

This journal article motivates the development of a framework for integrating credit risk and reward across the enterprise and describes its necessary components.

Articles

18 Apr 01

Implementing a Comprehensive Credit-Risk-Management System - The Case of Hanvit Bank

This journal article describes development and implementation of the key credit-risk analytic applications at Hanvit Bank.

Articles

14 Dec 00

Building a Credit Risk Valuation Framework for Loan Intruments

This journal article presents a general option-valuation framework for loans that provides valuation information at loan origination and supports mark-to-market analysis, portfolio credit risk and asset and liability management for the entire portfolio.

Articles

23 Nov 98

A one parameter representation of credit risk and transition matrices

This journal article presents a one-parameter representation of credit risk and transition matrices.

Articles

20 Oct 98

Expect the unexpected

In this journal article, we develop a direct approach to measuring credit risk at the transaction level.

Articles

17 Jun 98

Improving Quantification of Risk-Adjusted Performance Within Financial Institutions

This journal article demonstrates ways to improve quantification of risk-adjusted performance within financial institutions

Articles

18 Mar 98

Creating Value From Both Loan Structure and Price

Shrewd pricing and structuring of loans can enable a bank to satisfy customers’ needs while meeting its own risk/return requirements. This journal article describes a pricing method that uses net-present-value analysis to examine trade-offs between price and structure.

Articles

4 Mar 98

The effect of systematic credit risk on loan portfolios and loan pricing

In this journal article, we discuss the effect of systematic credit risk on loan portfolios and loan pricing by treating correlations as arising from a single systematic risk factor.

Articles

10 Feb 98

Incorporating New Fixed Income Approaches Into Commercial Loan Valuation

Accurate loan pricing has never been more complex than it is today and it has never been more critical to price accurately. This journal article discusses differences between some traditional and more sophisticated methodologies.