IFRS9 Credit Model budgets can be reduced by up to 30%

29 November 2021

Satisfying multiple regulatory and risk management objectives for banks today requires sophisticated credit modelling and a flexible architecture. At the same time, the complexity of the Global Covid Pandemic has made risks much more dynamic and uncertain. Add all of this together and CROs and CFOs require credit model solutions, which support all of these complex objectives, that are both more accurate and more flexible – and which actually reduce model build and maintenance costs at the same time.

Read and download the full article >>

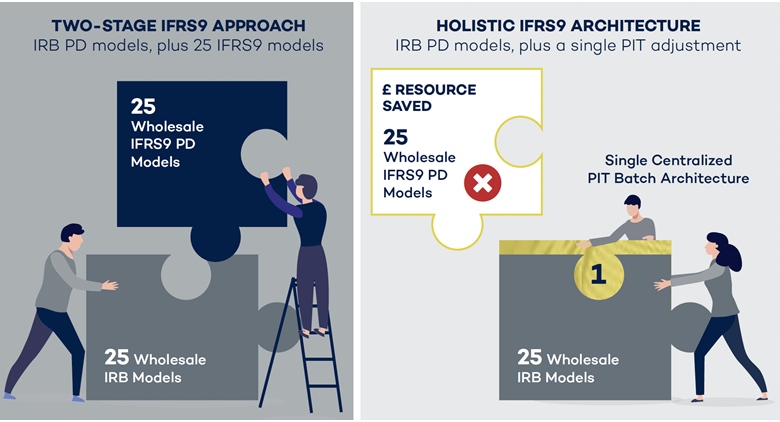

Supporting IRB credit model requirements together with newly established IFRS9 requirements is a good example of the complexity banks face. IRB requires Through-The- Cycle (TTC) based credit models, whereas IFRS9 for wholesale credit portfolios requires ‘forward-looking’, Point-In-Time (PIT) models. This has led many banks for their wholesale credit portfolios to build IFRS9 models that are closely related to their IRB models.

We calculate in an illustrative benchmark exercise described in this article, that banks could save up to 30% of their credit model operating budgets – by utilizing a single, holistic IFRS9 model architecture – where IFRS9 models are independent of IRB models. As opposed to building separate IFRS9 PD models for every IRB model, it’s possible to apply macro-economic and more detailed credit cycles in a batch architecture that takes IRB models as direct inputs.

Read and download the full article >>